china's path towards consumption-led growth in the new era

author: wang wei and wang nian

consumption is the mainstay of an economy’s aggregate demand, the fundamental driver of large economies, and a cornerstone of a secure, well-managed, and resilient economic system.1china’s new strategic priority is to effectively expand and better meet domestic demand especially household consumption. over the past decade, china has gradually transformed into a pattern of domestic demand growth driven largely by consumption. to this end, it is imperative to form an integrated system for consumption-led domestic demand with four main features and introduce a new growth mechanism for efficient alignment, strong stimulus, accelerated innovation and orderly transformation. more robust reform measures are needed to keep unlocking potential domestic demand and fuel growth in china and the world in a more stable and sustained manner.

understanding the great momentum and great potential of consumption-led expansion in china

since the beginning of reform and opening-up in 1978—and especially in the past decade—china’s consumption demand has steadily expanded, and has become the mainstay of the entire economy. the contribution of consumption to gdp and gdp growth has outpaced investment since 2015. in 2019, consumption contributed 58.6% to gdp and 3.5 percentage points to gdp growth, while investment contributed only 28.9% and 1.7 percentage points respectively. as this consumption-led development pattern takes shape, china will continue to unlock enormous potential in the coming decade as it catches up with developed economies in consumption and even outperforms them in consumption innovation.

great potential to further expand domestic demand with consumption

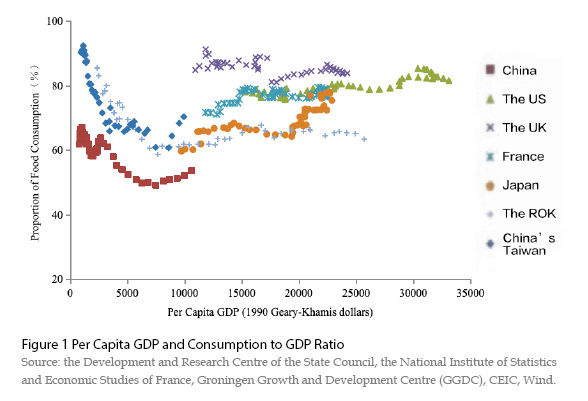

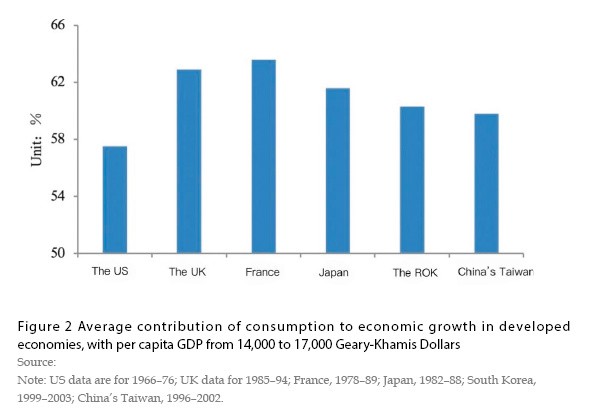

first, consumption plays an increasingly important role in expanding domestic demand and promises to contribute more to economic growth. according to the experience of developed economies, as per capita gdp grows, the share of final consumption in gdp will take a u-shaped curve, starting to move upward during the advanced stage of industrialization (figure 1). in recent years, china’s consumption to gdp ratio has entered an upward trajectory, reaching 54.3% in 2020—5 percentage points higher than the low recorded in 2010. during the 14th five-year plan period (2021-2025), china’s per capita gdp is expected to grow from 14,000 to 17,000 geary-khamis dollars. 2 with reference to the precedents of developed economies with similar per capita gdp, in 2025, china’s consumption-to-gdp ratio could grow to 60%, with 90 trillion yuan in final consumption expenditure. consumption’s contribution to gdp growth in the next five years will stay above 60% (figure 2).

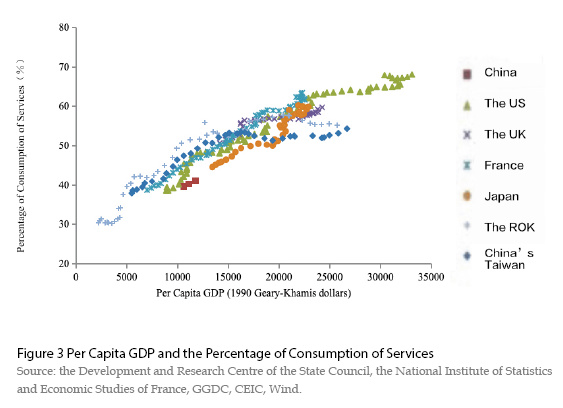

second, the immense potential for structural upgrading will make service consumption a major source of increased household consumption. when per capita gdp reached about 14,000 geary-khamis dollars, developed economies had services consumption accounting for 49 per cent of total consumption. when per capita gdp climbed to 17,000 geary-khamis dollars, the share of services consumption rose to 53% (figure 3). china’s consumption of services constituted 45.9% of total household consumption in 2019. it is estimated that by the end of the 14th five-year plan period or at the beginning of the 15th five-year plan period (2026–2030), the share will rebound to 50%. more importantly, higher household income and upgraded demand will reshape the structure of service consumption. medical, entertainment and cultural consumption will increase.

third, as consumption moves to the next level in the quest for better quality, it will unlock the growth potential of durable goods consumption. in general, the share of durable goods in household consumption has declined steadily in developed economies. as per capita gdp reaches a higher margin, consumption of durable goods will become more reliant on the trade-up of stock items than on incremental generation. this is particularly true for automobiles, apartments and electrical appliances. chinese consumers have started to replace old cars with much more expensive new models; however, the replacement ratio still lags behind developed economies.

fourth, evolving consumer preferences suggest an exciting outlook for food consumption. in developed economies, food consumption declined before stabilising in relation to total consumption expenditure (figure 4), with the distribution of food consumption showing a growing appetite for healthy and high-quality products. in the same vein, chinese consumersare now choosing nutritious, fresh and reliable food.

emergence of five structural factors that will drive growth and diversify consumption demand

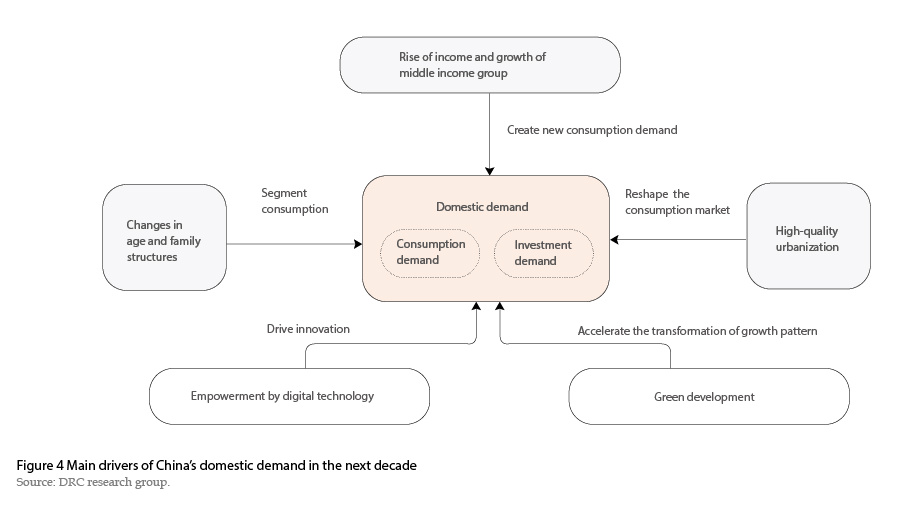

the next decade will see a series of structural changes in china’s economic development that will become the main engines of domestic demand growth, especially consumption growth (figure 6).

first, consumption growth and upgrading will be driven mainly by income growth and the growing size of the middle-income population. the experience of developed economies indicates that, as the economy approaches the high-income threshold, it will be a critical moment for the growth in national income and the expansion of the middle-income group. for instance, in japan, south korea and china’s taiwan, when per capita gdp reached 10,000–17,000 geary-khamis dollars, the size of the middle-income group enlarged relatively fast year on year before flattening out (figure 5). the middle-income group has a higher marginal propensity and stronger ability to consume and will pursue high-quality consumption items and new lifestyles. china has the world’s largest middle-income population with the greatest potential for expansion. by 2018, china’s middle-income group increased to 380 million, or 27% of the national population—up by more than 92 million and 6 percentage points from 2013.3 it is estimated that, by 2030, the middle-income group will account for 51% of the total population and contribute 79% of household consumption.

second, evolving demographics and household structure will further diversify and segment consumption. in 2020, the number of chinese consumers aged 15–34 was 360 million, constituting 25.8 per cent of the total population. this group belongs to an era of abundance and the internet. better educated and always craving the new, they are the most pro-innovation subgroup of consumers. the consumption market created by generation z4 is projected to reach 16 trillion yuan by 2035. meanwhile, the number of people aged 60 and above exceeded 260 million in 2020, or 18.7% of the total population, while those aged in their sixties made up 55.8% of the total aged population. with adequate time and wealth at their disposal and generally good health, the elderly play an essential role in the growth of consumption. it is predicted that, by 2030, china’s ‘silver economy’ will be worth 20 trillion yuan. third, high-quality urbanization will reshape the landscape of consumption growth. china’s urbanization rate has been over 60% and has remained on the fast track recently, but it is still about 20% lower than that of developed economies. closing this gap will drive consumption growth and related investment. when urbanization enters a new phase dominated by the rise of urban clusters and metropolitan areas, large central cities will become stronger magnets for population and other factors, drawing on consumption markets, lifting those already in large central cities to a higher end and accelerating new consumption patterns. these dynamics will recharge consumption in major central cities and turn some into world-class consumption hubs.

fourth, the penetration of digital technology will enable innovation in consumption. the boom and application of digital technology have brought about a constellation of consumption innovations, redefining how people consume. in recent years a multitude of business models has thrived, including social and livestream commerce and community group-buying. these online models aggressively embrace innovation, diversify consumption scenarios and create new consumer demands, thus contributing to the growth of domestic demand. it is anticipated that, by 2025, china’s online retail sales will reach 18.5 trillion yuan—up by 9.5% year on year during the fourteenth five-year plan period and 3.5 percentage points faster than the growth in total retail sales of consumer goods. as drc estimated, each unit of incremental online consumption creates 0.36 of a unit of total consumption..

fifth, green transformation will guide an environmentally friendly transformation of consumption. green and low-carbon growth are inherent in china’s socioeconomic development and will remain priorities for the growth of domestic demand and consumption upgrading in the years to come. in response to resource and environmental challenges in the wake of overheated growth, china actively promoted green modes of production and lifestyles and advocated reasonable and moderate consumption to achieve sustainable development.

a series of trillion-rmb growth poles of consumption will turbocharge domestic demand

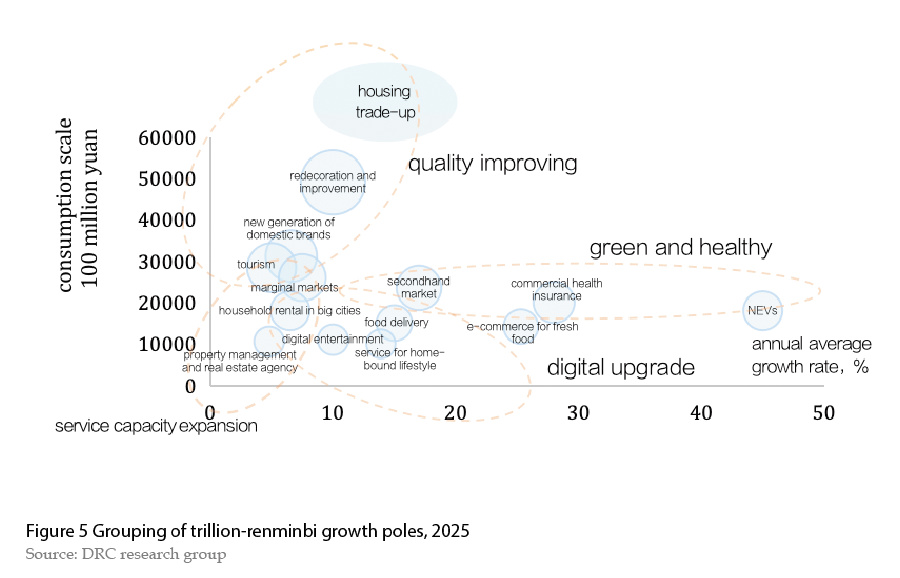

in the decade to come, the structural factors mentioned above will create a series of consumption and investment drivers with huge economies of scale, which will translate into prominent growth momentum and spillover effects.

estimations by the drc research team show that, by 2025, the five structural factors will nurture 39 domestic demand drivers, including 29 of consumption growth and 10 of investment growth. among them, 14 consumption poles and four investment poles will command scales in the trillion-renminbi range. these consumption poles will be focused on four engines of residents’ demands: quality upgrading, green and healthy transformation, digitization and service capacity expansion.

in terms of quality upgrading, the focus will include housing trade-up, interior decoration and improvements and consumption of emerging domestic brands. with rising household income, urban and rural middle-income groups have a growing demand for better housing, especially larger homes with more bedrooms. better-quality residential environments and interior decoration are also on their wish list. it is estimated that, by 2025, china will be home to about 160 million urban middle-income households. assuming they replace their housing every eight years, the average floor space per household is 104.8 square metres and housing prices grow by 5 per cent per annum, the value of demand for housing trade-up will reach 22.8 trillion yuan by 2025. if 1.2% of houses are redecorated every year, the total spending will amount to about 440 billion yuan annually. in addition, to satisfy consumers’ evolving tastes and appetite for high-quality goods, an explosion in domestic brands is taking place in multiple areas with shortening intervals between product releases. statistics show that, in 2019 alone, emerging domestic brands contributed 44.8% of the sales growth on sampled commercial platforms. assuming annual growth in total retail sales of consumer goods reaches 7% in 2022–25, online sales contribute 26% of total sales of physical goods and new domestic brands account for 48% of incremental consumption expenditure, the aggregate consumption of these brands will stand at 3.1 trillion yuan in 2025.

green and healthy transformation is most manifest in the consumption of new-energy vehicles (nevs) and commercial health insurance. fueled by peak carbon and carbon-neutrality goals, the market penetration of nevs in china soared to 13.4% in 2021 and is expected to reach 30% in 2025, with 9 million units in sales volume and 1.8 trillion yuan in market size. the ageing population highlights the significance of commercial health insurance to finance the aged care system. consumption in this regard is forecast to surpass 2 trillion yuan in 2025.

digitization will see a pivot to online consumption in smaller cities and towns and the use of e-commerce to purchase fresh produce. the consumption potential in smaller cities and towns will continue to be unleashed, with deeper penetration of digital technologies and improvements of digitalized distribution systems and commercial infrastructure in rural areas. the 14th five-year plan set an annual growth target of 7.5% for online retail sales in rural areas, which means online consumption in these currently marginal markets will reach 2.6 trillion yuan by 2025. digital transformation in the retail sector is accelerating, fostering new business models like fresh produce ‘o2o’ (online to offline purchase and delivery services), ‘intelligent’ wet markets and community group-buying, which are becoming pillars for the upgrading of food consumption. considering the growth momentum of online retail, in the next five years, retail sales of fresh food will grow by 6% per annum, raising the penetration rate of fresh produce e-commerce to 21% and its total consumption expenditure to 1.4 trillion yuan.

for service capacity expansion, the key lies in the provision of rental housing in major cities, real-estate agencies, property management and other housing-related services. big cities with net population inflows have strong housing demand, especially for rental housing for newly urbanized residents such as migrant workers and college graduates. it is estimated that due to the population growth triggered by urbanization, by 2025, urban market demand for rental housing will soar to 48.3 million units, or 1.8 trillion yuan in market value. according to the 14th five-year plan, consumption of housing-related services such as property management and real estate agencies will grow by 4.8% per annum, reaching 1.1 trillion yuan in 2025.

additionally, consumption expansion will engender four trillion-renminbi investment growth poles: green construction, digital infrastructure, renovation of shanty towns and the recycling industry. investment in these sectors will reach 15 trillion yuan, 5.2 trillion yuan, 1.8 trillion yuan and 1 trillion yuan, respectively, by 2025.

it is expected that during the 15th five-year plan period, these domestic demand growth poles will expand in scale while maintaining their momentum. meanwhile, the consumption of healthy food and vocational training will join their ranks. by then, consumption growth will benefit from a total of 16 trillion-renminbi poles. battery swaps and recharging infrastructure will form a new trillion-renminbi growth pole on the investment side, with potential accumulated investment of 1.1 trillion yuan.

new requirements for further economic reform and developmentbetter matching supply and demand

a diagnosis of the supply–demand alignment shows that industrial and consumption upgrading are not synchronized and the manufacturing capacity of high-end products is inadequate. the global competitiveness report 2019 issued by the world economic forum (wef 2019) placed china 24th in the ranking of global innovation capacity and 28th for overall competitiveness—a stark contrast to its position as the number-one manufacturing powerhouse. the service industry also reports gaps in supply and innovation competence, with the consumer services subsector relatively underdeveloped. challenges include inadequate regulations and standards for education, healthcare, rehabilitation, aged care, childcare, culture and entertainment; infrastructure capacity gaps; lack of professional training and qualifications; and gaps in innovation capabilities. all these have added to the supply–demand mismatch, making it difficult to meet personalized, stratified and diversified consumer needs.

a diagnosis of investment–consumption interaction shows that the market is not playing its role in guiding investment. the priorities for investment and consumption upgrading are not fully aligned, leading to low returns on investment and excess capacity in certain areas. furthermore, efforts are still needed to balance public and private investment. there is a shortfall of government investment in basic public services5and related weak links. practice should be improved to mobilize and channel private capital and foreign investment to the fill the gap.

improving household capability and consumption through optimizing income distribution and the social security system

household income is underrepresented in primary distribution in 2020, after modest growth in the previous years, china’s gini coefficient stood at 0.468, in the upper–middle range globally.

the middle-income group is a primary driver of consumption growth and innovation. between 2013 and 2019, the per capita disposable income of this group grew by 8.1% year on year—slower than both the high-income group (8.5%) and the low-income group (9%). in 2018, the middle-income population reached 380 million, which was 27% of the national total; however, their potential has been pent up in comparison with advanced economies.

great efforts have been made to improve china’s social security system. in 2019, employees covered by pension insurance accounted for 41.3% of the total workforce, while those covered by basic medical insurance accounted for 32%, workplace injury insurance 33.3% and unemployment insurance 28% (nbs). more progress is needed to increase the coverage of the safety net.

transforming and upgrading the distribution system to facilitate economic circulation

innovation and digital transformation of the distribution system are not occurring fast enough—in particular, the application of modern technology, facilities and equipment is suboptimal at many small and medium-sized distribution enterprises. as a result, they struggle to adapt to the needs of emerging business models, services and scenarios.

the distribution system is not playing a strong role to support the upgrading of the manufacturing industry. china has few modern distribution enterprises that enjoy world-class branding, networks and competitiveness, making it difficult to channel market signals on segmented and rapidly iterating demand to upstream players in a timely and accurate manner.

barriers to urban–rural connectivity for consumption and distribution must be removed. rural areas lag in the development of information and digital infrastructure, the construction of commercial outlets and the availability of e-commerce infrastructure, such as cold-chain, delivery and other supporting services.

improving the market environment in response to the need for domestic demand innovation

china’s institutional environment has yet to be optimised for fuel consumption. current market access and regulatory policies are not fully adapted to the requirements of innovation and development, particularly for new consumption models such as live streaming and social commerce, night-time economy, community group buying and innovative initiatives for business model convergence, industrial integration, business diversification and hybrid consumption scenarios. in addition, consumer protections must also be strengthened.

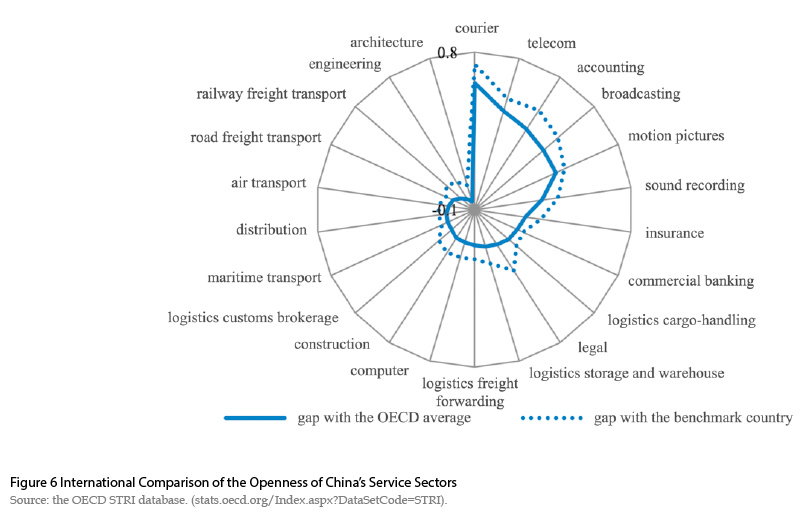

china must step up its institutional opening to service consumption. in 2020, the openness of many service sectors fell below the organisation for economic co-operation and development (oecd) average6 (figure 6). market access for foreign investment remains restricted in many service sectors, such as healthcare and culture. insufficient openness limits the options available to domestic consumers.

thoughts on expanding and better meeting domestic demandsix strategic priorities for expanding and better meeting domestic demand

innovation will lead to the emergence of new drivers of domestic demand. all kinds of market players should be supported for innovation in technology, management and business models, to expand service consumption and fertilize new industries, business models and formats. emphasis should be placed on a greater variety of higher quality options to be provided by branded vendors. effective supply of mid-to-high-end goods and services will be stepped up to create and meet the increasingly diversified and segmented demands of all consumer groups.

digital transformation will provide a lever to lift the dynamic balance between supply and demand to the next level. digital transformation will move up from the consumer end to the supply end and spread from sporadic entry points throughout the value chain. data, as a new production factor, should be fully leveraged and a rapid response mechanism should be put in place to flexibly adjust capacity. high-quality consumption represents an opportunity to enhance supply–demand alignment, which will make the supply system more adaptable and innovative and create the foundation for a modern digital, smart and green distribution system.

the middle-income group will be the main contributors to sustainable growth of consumption-led domestic demand. steps should be taken to steadily increase household income, equal access to basic public services, optimistic government services for employment, increase human capital among low-income groups, bring more skilled workers and migrant workers into the middle-income group and build a strong social safety net for the marginal middle-income population.

young people will be a focus on galvanic consumption potential. they can set good examples for consumption innovation and take the lead in upgrading and expanding consumption. innovative and upgraded consumption will lead to an ecosystem based on online–offline integration and coordination. as family size declines, suppliers must acquire both capacity and capability to meet the need for mass consumption and customized convenience.

large cities will serve as hubs for piloting and fuel consumption. measures must be taken to promote high-quality urbanization, develop urban clusters and metropolitan areas, strengthen infrastructure connectivity and boost the economic vibrancy and population capacity of leading cities, urban clusters and other areas with development advantages. there is also a need to build international consumption hubs and enhance their global influence and capability in resource allocation. the multiple functions of rural consumption will be further explored to build an integrated urban–rural consumption system.

green development will provide an opportunity to promote a new model of sustainable development for domestic demand. it is important to stimulate a green transformation of consumer behaviour, improve the supply capacity and quality of green products and services, and accelerate the development of a green low-carbon consumer market. moreover, steps should be taken to improve the system of standards for green products, reduce the costs of green production and improve the efficiency of resource consumption.

orientation of future reforms to expand and better meet domestic demand

to achieve china’s long-term goal of building an integrated domestic demand system, future economic reforms must focus on the following aspects. firstly, deepening the structural reform of the supply side to ensure the effective operation of market supply. secondly, accelerating income distribution reform and optimizing social policies to increase affordability and consumption levels. thirdly, improving consumption growth policies to strengthen the institutional basis for expanding domestic demand. for example, public holidays and paid leave policies should be improved, and the consumer protection system, particularly in service sector, should be strengthened. fourthly, converting and upgrading manufacturing to create a virtuous cycle between investment and consumption. fifth, scaling up the institutional opening of the service industry to promote mutual reinforcement between domestic and international circulation.

furthermore, addressing weak infrastructure links to better unlock potential domestic demand is essential. additionally, enhancing the green consumption system to foster a green and healthy consumption culture is imperative.

lastly, developing a statistical system that is responsive to the requirements of domestic demand development, particularly by strengthening statistics and capacity building in the service sector with digital technology, is crucial.

wang wei is senior research fellow of institute of market economy, development research center of the state council

wang nian is associate research fellow of institute of market economy, development research center of the state council