the rmb should regain a solid footing in 2024

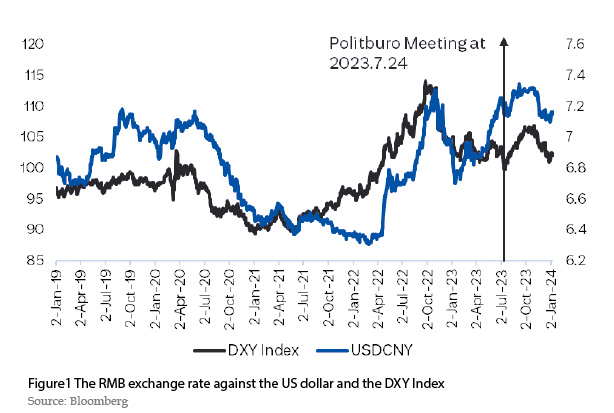

after a volatile year in which the rmb was under considerable depreciation pressures, the rmb exchange rate has regained its footing and has since moved below 7.3, an upper bound the people’s bank of china (pboc) may view consistent with china’s macroeconomic fundamentals. two factors contributed to the stability of the rmb. internally, china’s economy achieved an impressive 5.2% yoy gdp growth in 2023, and the growth momentum for 2024 remains stable, with a consensus forecast of china’s gdp growth at around 4.6% published by bloomberg. externally, the us inflation has been falling to 3.4%, and the us core cpi without the shelter component has already reached 2.5% by the end of 2023. the fed has since signaled that a first interest rate cut could be in the 2nd half of 2024 at its december fomc meeting. the dxy index has since weakened, although still volatile, and external pressure for the renminbi to depreciate has largely weakened. pending china’s economic targets to be announced at the national people’s congress in early march, it is highly likely that the rmb exchange rate will regain a solid footing in 2024.

the us interest rate cycle won’t support a strong dollar